Which Item Cannot Be Used to Secure a Debt

In the case of a debtor who has defaulted on an auto loan the lender may decide to repossess the car thereby securing the property for the bad debt. Mortgages and car loans are two examples of secured debts.

How We Paid Off Over 4000 In Debt In Just 3 Months Read My Full Story Follow The Steps And Start Paying Off Debt Free Plan Debt Free Paying Off Credit Cards

You can use anything of value to secure a loan.

. With respect to personal property most states have specific exemptions for specific types of property. The children are not responsible for the debts unless a child co-signed a loan or credit card agreement. In the event a borrower defaults on their loan repayment a.

A lender enters into a debt agreement with a company. It can take other actions to get you to pay what you owe if you default. Unlike security agreements financing statements dont have to signed to be effective.

Pawn shops make their money this way making small loans in exchange for assets the borrower brings in. In terms of a persons assets land is unique in that a debt can be secured against it without the owner giving up control of the asset. Which type of debt is secure.

Should a default happen the items listed in the inventory can be sold by the lender to recoup its loss. An unsecured lender isnt without recourse however. Loans or debts or credit cards cannot be hypothecated against loans.

Alimony or child support. Items can of course be bought on hire purchase agreements but these remain the property of the seller until the debt is paid and an item can be pawned but the pawnbroker will retain it pending full repayment. Unsecured debt is any debt that is not tied to an asset like a home or automobile.

A successful lawsuit can be used to garnish your wages take an asset that wasnt tagged as collateral or put a lien on your assets until youve paid off your debt. A _____ is not an example of collateral. What to Know Before You Sign a Loan Agreement.

You typically encounter secured debt when you purchase a large ticket item such as a house or a vehicle. But unsecured debt could also include a personal loan loans from friendsfamily unpaid rent etc. Federal law protects Social Security and disability benefits from debt collectors with or without a judgment.

Credit card cannot be used to secure a debt. A creditor can file a financing statement as long as you have signed the security agreement for the collateral that it is supposed to cover. Basically unsecured debt is any debt that is not attached to some type of property.

When a person dies his or her estate is responsible for settling debts. All of the above. Rented or leased property cant be used as collateral because the borrower doesnt have the right to give it up.

The company cannot borrow debt that is senior to this debt. Some lenders may charge high interest rates or high fees for secured personal loans especially if you have bad credit. The second part of a secured debt is the creditors legal claim lien or security interest on the property that serves as collateral for the debt.

Fines or penalties owed to the government. Secured debt is debt that is backed by collateral to reduce the risk associated with lending. Debts you did not list in your bankruptcy petition.

Most protect typical household goods health aids clothing and a motor vehicle up to a certain value. It might hire a debt collector to pursue you and try to get you to pay the debt. In certain situations where a debtor has defaulted or is extremely delinquent the lender may decide to try and secure the bad debt by seizing the property of the debtor.

The company must maintain an interest coverage ratio of 370 based on cash flow from operations. Unsecured debt creates less stress and fewer problems for consumers because they dont stand to lose an asset if they dont repay the debt. Unsecured creditors do not have the right to seize a debtors property once the debtor has defaulted on the.

Sometimes when people file for bankruptcy their creditors may file an objection to stop the debts from being discharged. If there is not enough money in the estate to pay off those debts in other words the estate is insolvent the debts are wiped out in most cases. Invoices are one of the types of collateral used by small businesses wherein invoices to customers of the business that are still outstanding unpaid are used as collateral.

The record collection house and cars are all assets and these can be used as a collateral against loans or debts. Secured debt Secured debt is debt that is backed by some type of collateral such as an asset or revenue from the borrower. The company cannot pay annual cash dividends exceeding 60 of net earnings.

For example a borrower may bring a microwave oven worth 50 to a pawn shop and ask for 15 loan against that secured asset. When you agree to pay a car dealer for the use of a new car during a set period of time for a set amount of money and you have to return it. This is why credit card is the answer.

Secured debt usually has _____. Which item cannot be used to secure a debt. Bankruptcy Code lists 19 different categories of debts that cannot be discharged in Chapter 7 Chapter 13 or Chapter 12 a more specialized form of bankruptcy for family farms and.

If you use a savings account or CD as collateral a minimum balance may be required. Some of the debts that cannot be discharged include. The lender may restrict how you use the money you borrow.

The debt agreement could specify the following debt covenants. Once your personal liability is eliminated the creditor cannot sue you to collect the debt. When discussing unsecured debt most debtors are speaking of credit card debt.

Personal loans can be used for a variety of reasons such as paying for a big-ticket item or consolidating credit card debt. This is because credit cards are themselves a form of debt or loan. This most commonly means credit card debt but can also refer to items like personal loans and medical debt.

A financing statement is a document that identifies the borrower lender and collateral for a secured debt. Home equity the difference between the current value and outstanding obligations can be used as collateral for a personal loan too. Debts That Cannot Be Discharged by Bankruptcy.

Teamupyourgame Com Consulting Starter Kit Potential

How To Become A Lawyer Without Debt How To Become Debt Advice Debt

23 Awesome Personal Finance Tips That Will Help Build Your Wealth Personal Finance Articles Personal Finance Finance

Secure Your Website With Low Cost High Value Ssl Certificates Faster Issuance Easy Enrollment Free Reissues Buy Ssl Certificat Tips Learning

What Is A Warrant In Debt And What Should I Do About It

Use This Site To See If You Qualify For A No Collateral Loan Up To 100k Small Business Credit Cards Secure Credit Card Business Credit Cards

Pin On Timelybills Bill Reminder App

How To Pay Off Six Figures Of Debt Classy Career Girl Money Quotes Debt Quote Financial Quotes

The 900 12 Week Holiday Savings Challenge Money Saving Strategies Savings Challenge Saving Money Budget

Pin On A Z Save More Spend Less

Complications Are There In Everyone S Life But It S On You How You Overcome Them Life Complications Confidence Building King Of Hearts Overcoming

Strength Quotes Forgetting It S Paydaypriceless Financial Freedom Quotes Freedom Quotes Inspirational Quotes

:max_bytes(150000):strip_icc()/terms-c-cross-collateralization-0cb8f66776c346949f9b7cf236ecefbc.jpg)

Cross Collateralization Definition

Computer Software Business Plan Template Google Docs Word Apple Pages Pdf Template Net Business Plan Template Business Planning Computer Software

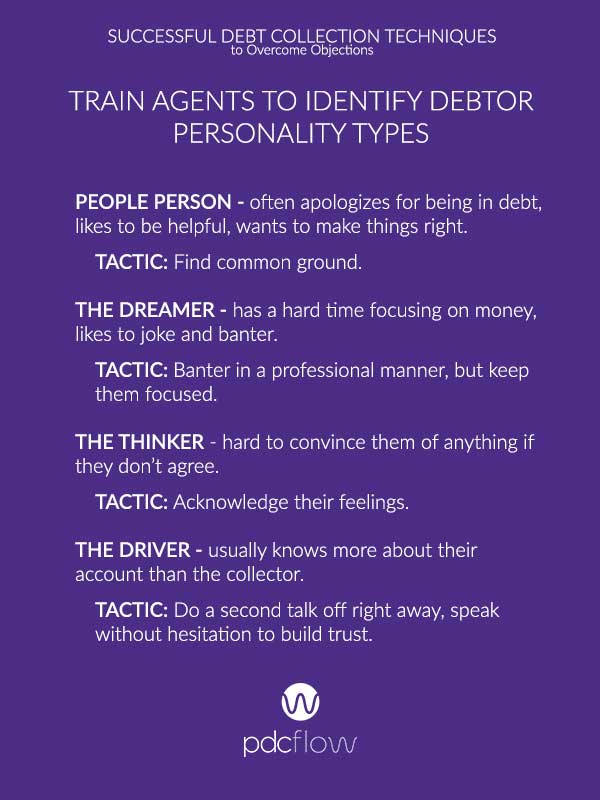

Successful Debt Collection Techniques To Overcome Objections Pdcflow Blog

Sample Financial Statement Analysis Example Financial Statement Analysis Financial Statement Analysis

What Is Dividend Investing Dividend Investing Investing Dividend